ImageCat and JBA Risk Management Partnership Provides First Consistent View of Global Flood Risk

02 Jun 2014

Partnership provides first consistent view of global flood risk (1.06mb PDF)

Re/insurers can now map all their flood exposures for 168 countries and for the first time get a single, consistent view of all their global flood risks, thanks to a partnership between JBA Risk Management and ImageCat.

Gavin Lewis, ImageCat Commercial Director said, “This is a real first for the insurance industry. Portfolios which have been improved using JBA’s Global Flood Map through inhance will produce better results when run against a cat model, and benefits flow through into pricing and risk selection, aggregation modelling, capital allocation, reinsurance and Solvency II compliance.”

The absence of consistent global flood mapping was a major difficulty for re/insurers with global exposures, explains Jill Boulton, Director of JBA Risk Management. “Rivers flow across country boundaries, sometimes through several countries. Assessing exposure across all countries was both complicated and inaccurate because the available maps varied in resolution and modelling technologies.”

JBA, which is the leading provider of UK flood maps, took an important step toward remedying this problem with the release of its Global Flood Map in 2013. Now thanks to JBA’s Global Flood Map being available in ImageCat’s new analytical platform inhance™, users can quickly and easily identify where their risks lie in relation to the maps’ flood outlines across all the world’s major river basins.

Jill Boulton said, “The current trend towards more erratic weather systems globally brings with it a greater risk of floods. Just recently, for example, three-months-worth of rain hit the Balkans in the space of a few days. Initial estimates indicate damages of more than one billion euros in both Bosnia and Serbia.”

Launched in May 2014, inhance offers JBA’s Global Flood Maps as part of its comprehensive range of hazard datasets. By using the JBA flood maps in inhance international property owners and re/insurers can get a better understanding of their flood exposures at address level, particularly for areas where they have non-modelled risks.

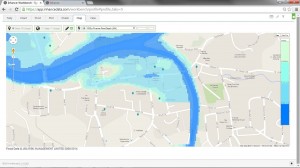

The image of Cockermouth shows how JBA flood maps can be used in inhance to identify and rank the exposure to flooding at an individual property level. It illustrates a modelled 1000 year riverine flood with the relevant depth of inundation.

Floods as natural catastrophes

Floods are the most frequent natural catastrophe and can have devastating consequences. The floods that hit southern and eastern Germany and neighbouring countries in June 2013 caused overall losses of €11.7bn and insured losses of €2.4bn, and were the year’s costliest natural catastrophes, according to Munich Re. Some 37% of overall losses worldwide from natural catastrophes in 2013 were flood-related.

Flooding has now been identified as the first of the three leading risks for Europe associated with climate change. In its latest report the UN Intergovernmental Panel on Climate Change (IPCC) said that if no additional steps are taken, flood damage to the European coast could increase by €11 billion a year. The number of people affected will also increase.

As Jill Boulton said, “More than ever before is there a need for re/insurers to fully understand flood exposure globally. As support grows for moves within the industry towards data sharing and transparency, we are pleased to be a part of inhance.”

562 628 1675

562 628 1675